Two important tools for New Wave Academy traders are the Fibonacci Retracement and Fibonacci Extension tools. Many new traders are unfamiliar with the Fibonacci sequence, the significance of the ratios, or how to use the tools to their advantage. However, many traders successfully use these tools as certain Fibonacci levels can be good indicators of support, resistance, and even reversals. Honing your skills with the Fibonacci tools can help you become a well-rounded and successful trader!

Get your free UPI System to begin trading in the crypto market [here]!

The Fibonacci sequence of numbers—discovered by and named after mathematician Leonardo da Pisa in the 13th century—occurs throughout the universe. The classic Fibonnaci sequence is the series that begins with 0 and adds 1. You then take that number and add the previous number to it, which gives you this sequence: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89 … to infinity. You end up with the Golden Ratio by dividing a Fibonacci number with the previous Fibonacci number in the series, for an example diving 89 by 55 equals 1.618. This golden ratio is found throughout nature, including sunflowerseeds, seashells, hurricanes, and even the human body.

How is this used in trading? Traders use Fibonacci tools to project highs and lows in all markets including crypto. Bitcoin and Ethereum also respect Fibonacci levels, but the power is knowing which levels are more probable—and therefore more tradable. By knowing the rules and guidelines of Elliott Wave, you can use Fibonacci levels more accurately by knowing which key levels are more probable of getting hit depending on its specific wave structure.

Fibonacci is a great tool you can use to find key support and resistance levels in crypto trading. Although, Fibonacci has many ratios that can get hit in the crypto markets so the power is using a trading system that pairs Fibonacci with Elliott Wave because it gives more probability on which key levels will get hit depending on specific wave structure and that’s what we teach here at the NewWave Academy. NewWave Traders use Elliott Wave and Fibonacci in a unique trading system that you won’t find anywhere else in the market.

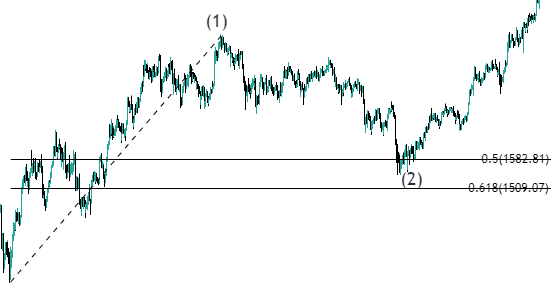

We use the Fibonacci retracement tool when we are dealing with a correction or countertrend (Wave 2, wave 4, b waves or complex corrections). For instance, when projecting a retracement, you would use the Fibonacci Retracement tool from two pivots: the bottom and top of a trend. This would give you different levels where you can expect price to pullback.

Impulse Wave Fibonacci Retracement

Wave 2 retraces from .236 to 99%

Wave 4 retraces to .236, .382, .5, .618 but can’t retrace into wave 1 territory

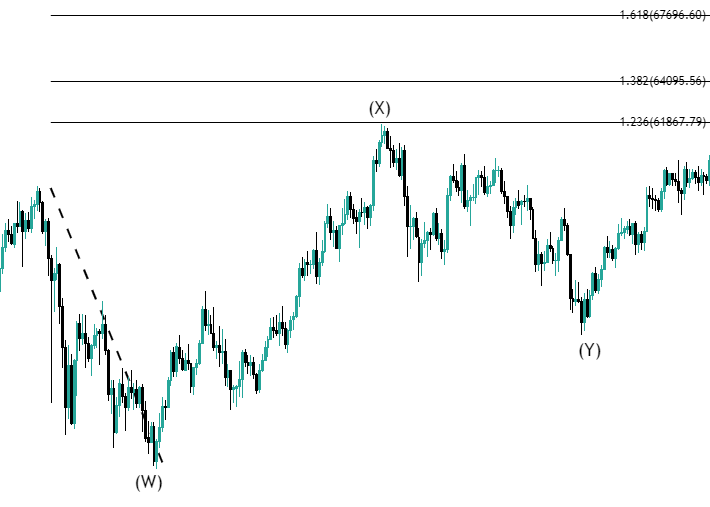

ABC Fibonacci Retracement

Zigzag B wave retraces up to 99% and as little as .236

Expanded B wave of the flat variations can retrace up to 1.618 retracement, but typically fall between 1.236 and 1.382

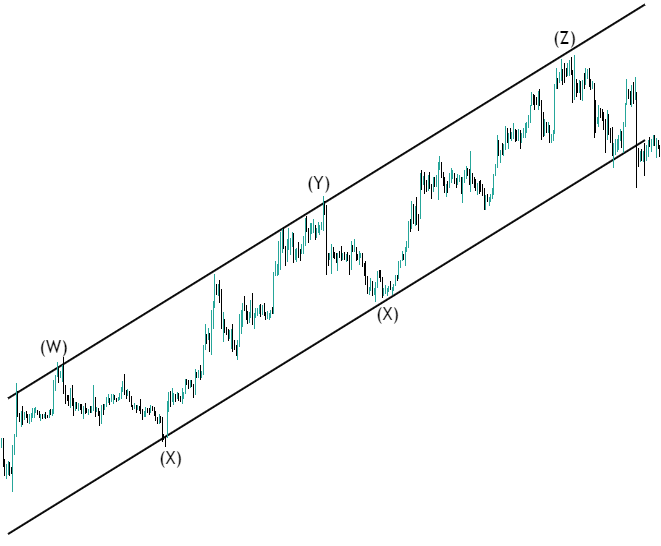

WXY & WXYXZ Fibonacci Retracement

X wave can be expanded and retrace up to 1.618 retracement

The 2nd X wave cannot retrace beyond the start of the 1st X wave

Fibonacci Extension

We use the Fibonacci extension tool to project future price action. For instance, when predicting a trend to continue, you would use the tool with three pivots: the bottom of the trend, top of the trend, and the potential bottom of the correction that has already taken place. This tool will help project targets at key Fibonacci levels where you may see support and resistance levels.

Impulse Wave Fibonacci Extensions

Wave 3 extends to 1.618, 2.236, 2.618, 3.236 and further

Wave 5 extends to 2.236, 2.618, 3.236 of wave 1 and is typically the same size as wave 1

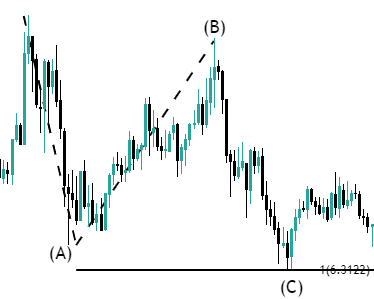

ABC Fibonacci Extensions

A and C tend towards equality meaning a 1:1 extension

Expanded flats can extend to 1.618 or larger

WXYXZ Fibonacci Extensions

Y and Z waves should not extend beyond 1.618 extension of W

The most efficient way to master trading in the crypto markets is to utilize a system that’s already been proven and has all the necessary components needed to ensure the highest probability of success. You can get started with the NewWave system by diving into our unique UPIS training materials absolutely free [HERE] and surrounding yourself around like-minded traders by joining our free discord channels [HERE].